Strategy Resources

Strategic Analysis ToolsLet us help you demystify strategic planning

Strategic Analysis

During the first steps of a strategic process analysis, assessment and research must take place. During this phase, it can be helpful to use some established strategic analysis tools. The following list is not exhaustive, but the selected tools cover all the bases.

Gap Analysis

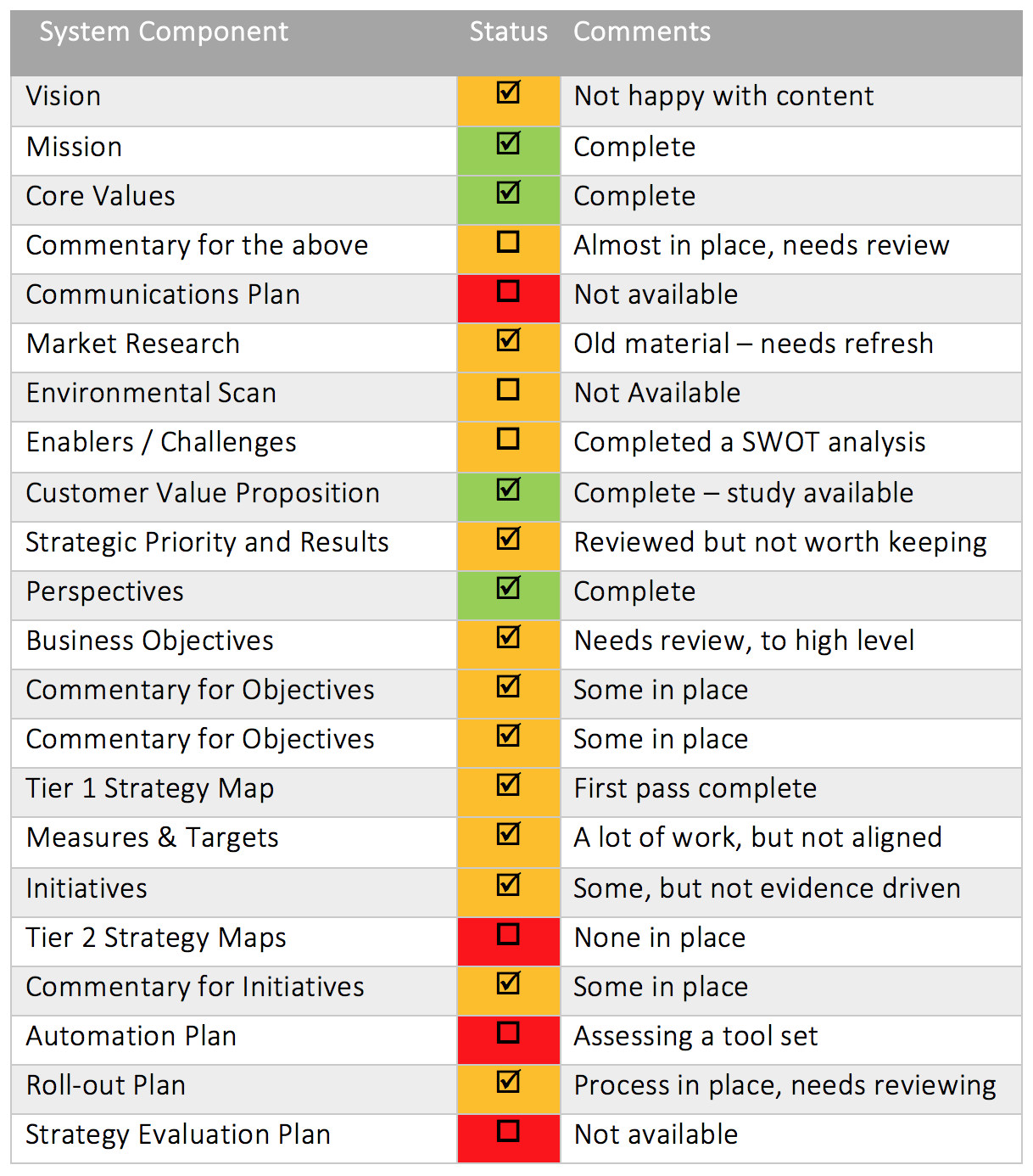

It would be very rare to enter a strategic process without having a previous strategy to consider. (Although this might be the case with a start-up company). Usually, there will be a lot of work that has been undertaken and a lot of people who have invested time and effort into formulating, communicating and implementing a strategy.

Previous work should never be thrown away. However, it should be validated and missing items should be identified. It is therefore always good practice to start with a Gap Analysis. As the title suggests, a gap analysis is an analysis of existing material to identify any ‘gaps’ that need to be addressed. To do this effectively, the first stage is to create a list of all the things that need to be included.

Care must be taken here. Simply creating a list is not the best way to approach a gap analysis. To paraphrase Donal Rumsfeld, the former US Secretary of Defence, “There are things we don’t know we don’t know.” To be sure you have a complete list you need to either benchmark a comparison to a similar industry (see Benchmarking below) or use an established, tried and tested general list. The book, The Institute Way, which describes the Balanced Scorecard strategic process uses a list like the one shown below:

The gap analysis should provide a good reference that can be returned to throughout the process to ensure all strategic activities are covered. It should also provide enough information to determine which of the following analysis techniques might be used. For more information and a free template refer to Why do I need a checklist?

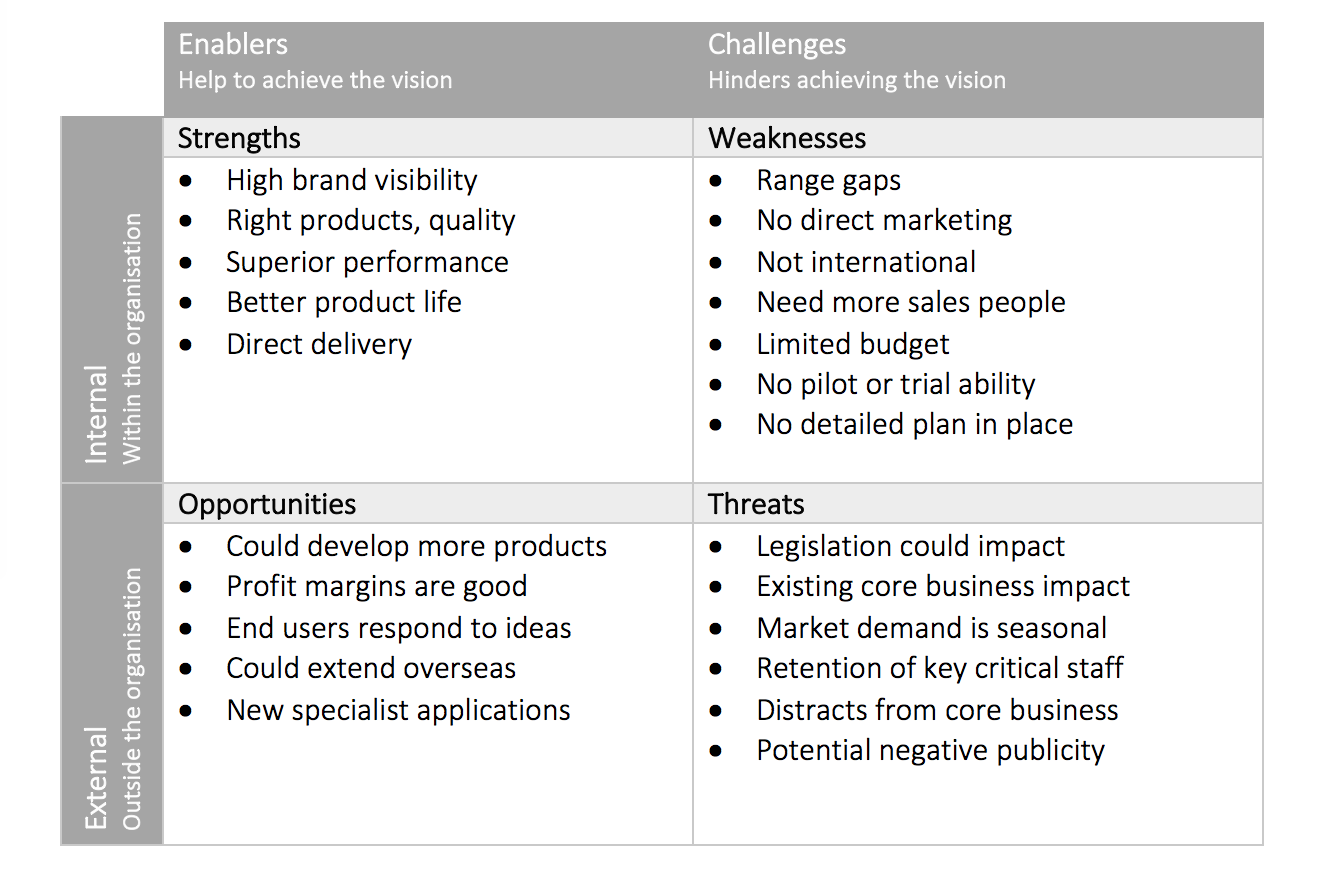

SWOT Analysis

SWOT stands for Strengths, Weaknesses, Opportunities and Threats. A SWOT diagram usually takes the form of a four-box quadrant and a set of short statements related to each element written in each box. Arranging the quadrants in the way shown below provides useful views by; internal and external focus (reading across) and; an enabler and challenge focus (reading down):

The purpose of the SWOT analysis is to summarise an overall position in a single chart. The following are some of the things to be considered for each area:

Strengths

- What advantages does the organisation have over others?

- What is likely to produce the greatest return on investment?

- What does the organisation do well?

- What would be the best thing to implement quickly?

- If we are not looking at an obvious area, why not?

Weaknesses

- What are the areas where we should and could do better?

- Which areas should we avoid altogether?

- What do our customers consistently complain about?

- What do our employees consistently complain about?

- Do we have any internal/external processes that are obviously slow?

Opportunities

- What are the obvious opportunities we can see?

- What are the current exciting trends in the marketplace?

- What are the predicted long-term trends in the market and technology?

- Are there any social, lifestyle or population changes we can exploit?

- What is happening with our existing development programmes?

Threats

- What are the biggest external obstacles we face?

- What are our competitors doing?

- Are there any government/regulatory changes we need to note?

- Can we keep up with technological changes?

- How good is our relationship with our suppliers?

A SWOT analysis is a very useful tool that can be used as part of a serious analysis or as a ‘warm-up’ exercise to kick-start a period of analysis. For the latter, it can show an organisation where, provided the right people are involved, a wealth of understanding can be gained by using internal subject matter experts.

PESTLE

PESTLE analysis, or the shortened version PEST analysis, is a mnemonic that stands for Political, Economic, Socio-Cultural, Technological, Legal and Environmental. It is a strategic tool used to look at ‘the big picture’. It focuses on changes to the business environment that can have either a positive or negative impact.

For example, a positive impact may be the introduction of a new technology enabling a company to reach a larger number of customers. A negative impact may be a change in safety legislation that results in an increased cost and therefore reduced profit.

The PESTLE process usually has three steps:

- Use the mnemonic to identify the ‘big-picture’ changes

- Identify the opportunities or threats resulting from the changes

- Build elements into your strategy to mitigate threats or take advantage of opportunities.

The following questions that can be asked for each element:

Political

- How stable is the government, is an election due?

- Who are the most likely contenders for power positions?

- Are there any pending tax or legislation changes?

- Is there a trend to regulation or deregulation?

- Are there any other political factors that may change?

Economic

- Is the economy stagnating, growing or declining?

- Are important exchange rates volatile?

- Is disposable income rising or falling?

- What is the unemployment rate?

- How easy will it be to build a skilled workforce?

Socio-Cultural

- Is the population growing, what is the age profile?

- What are the current employment patterns?

- Are there any generational shifts in attitude?

- Are there changing attitudes to regular employment?

- Do lifestyle or religious choices impact products choice?

Technological

- Are there new technologies on the near horizon?

- Do your competitors have access to new technologies?

- Are there research bodies you should be affiliated to?

- Are technological changes causing social change?

- Are there new communications system available?

Legal

- Have there been any recent major changes to law?

- Are there any recent international changes to law?

- Have any regulatory bodies been highlighted?

- Has consumer protection changed or about to change?

- Are there any new industry specific regulations?

Environmental

- Do environmental issues impact your products?

- Have your stakeholder or investor values changed?

- Does pollution or waste management impact you?

- Is staff engagement and morale high or low?

- Are there any global factors that need consideration?

Once a set of big-picture factors has been identified they should be categorised as opportunities or threats. The factors can then be used in the strategic process to develop objectives that either mitigate the problem or take advantage of the opportunity.

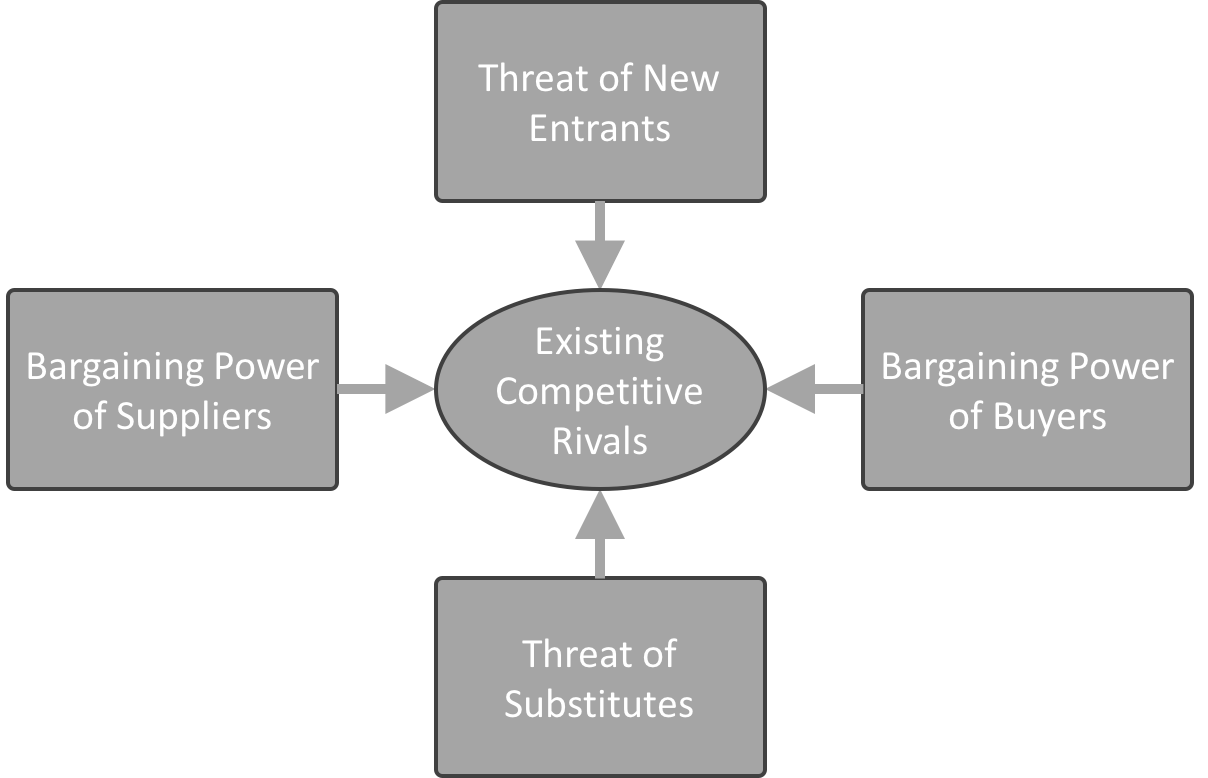

Porter’s Five Forces

Unlike PESTLE analysis which concentrates on a big-picture, Michael Porter of Harvard University, the principal innovator of the ‘Five Forces’ suggests that this analysis is aimed at micro-environment. That is, it looks at the forces close to a company that affect its ability to serve its customers and make a profit.

The five forces are:

- Buyers – Buyers are always happier to pay less and get more. In the mobile phone network industry price competition is fierce. Consumers simply want the cheapest connection option.

- Suppliers – Suppliers want to be paid more to deliver less. Powerful suppliers will insist on higher prices or more favourable terms. Especially when they are the only supplier in town.

- Substitutes – Where a product or service can be easily substituted for something else. These may not be obvious rivals, they may come from different industries.

- New Entrants – New entrants can often cause tension. Occasionally a new company arises that does something differently at a lower cost but provides the same service. This can cause existing companies to spend more to retain customers.

- Existing Rivals – The existing competition still needs to be accounted for and intense competition reduces everyone’s profitability.

These five forces define every company/organisation structure, once they are understood they can be used to shape the future and enable better predictions and a more competitive strategy.

The following questions can be asked to identify factors related to the five forces:

Bargaining Power of the Customers

- How many buyers are there in the market?

- Can the buyers ‘group’ together to buy in force?

- Are the buyers concentrated in a geographic region?

- Can a buyer switch easily?

- What is the total amount of trading?

Bargaining Power of the Suppliers

- How many suppliers are there in the market?

- Which of the supplier’s control prices?

- How easy is it to switch to a new supplier?

- How different are the supplier’s services/products?

- How good is the supplier’s distribution channel?

Threat of Substitutes

- How easy is it to find a near-equivalent?

- Can the service be outsourced?

- Can the service be automated?

- What is the perceived level of differentiation?

- Are quality, availability or price determining factors?

Threat of New Entrants

- How easy is it to start this line of business?

- What are the major barriers to entry?

- Are there any regulatory or government policy requirements?

- Are there significant established economies of scale?

- Is customer loyalty or brand loyalty an influencing factor?

Existing Competitive Rivalry

- What is the existing level of competition?

- What is the competitive situation?

- Are there opportunities for innovation?

- What is the customer acquisition cost comparison?

- What is the level of transparency between competitors?

The five forces are often presented in a diagrammatic form with Existing Competitive Rivals in the middle indicating both the importance of this force and the impact the other forces have upon it.

Benchmarking

Strategically you should not be looking at improved results in comparison to your organisation’s previous results. A 10% increase in sales may appear to be a good thing, but it becomes insignificant if your nearest competitors are increasing sales by 30%. The same applies to many other factors, for example, the introduction of new technology or customer satisfaction.

To ensure you can compete effectively, you must compare your performance to the best in the industry. This is benchmarking. By looking at industry standards you can see how you are progressing to a reference other than your own performance.

In some instances, it may be worthwhile looking at ‘similar’ industries rather than the same as your own. For example, in the last decade, a well know airline gained a massive competitive advantage (granted for only a short time) when examining airport turnaround times. Rather than looking at other airlines, they looked at the motor industry, specifically motorsports. They carefully examined what happened during pit-stops. They we able to translate some of the activities to a much larger scale and improve the airport stop-overs considerably. The net effect was more scheduled flights that had fewer delays.

Benchmarking can be undertaken in a formal or unformal way. Formal benchmarking usually requires a source benchmark to be either purchased or researched by a benchmarking organisation. Output from formal benchmarking can be of high quality and provide valuable insights, however, its preparation can be expansive and time consuming.

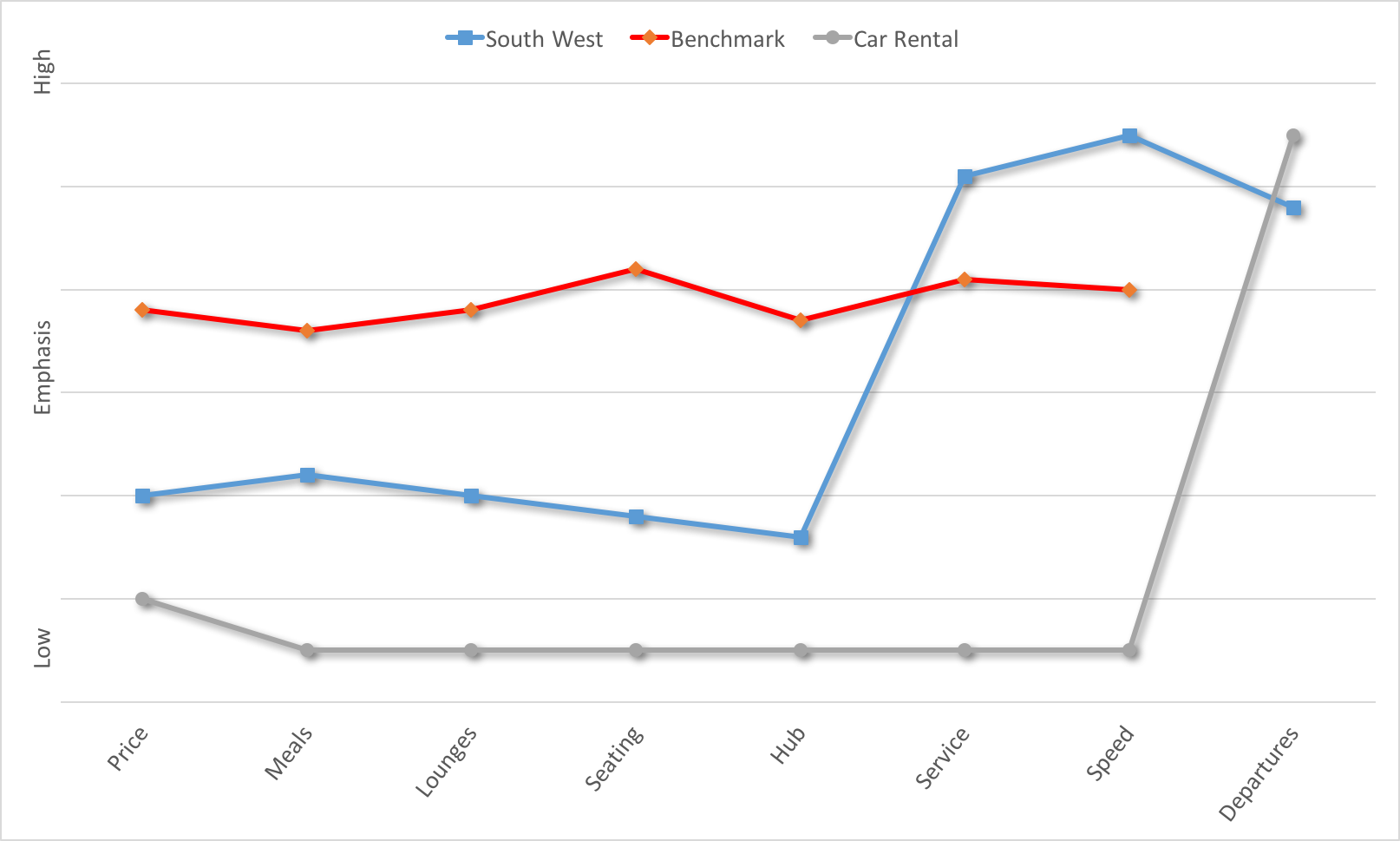

Informal benchmarking requires some level of research as well but can also be undertaken by subject matter experts who simply apply common knowledge. Benchmarking brainstorming sessions can be remarkably effective. One method often used in informal benchmarking is the use of a ‘Strategy Canvas’.

The Strategy Canvas is one the Blue Ocean Strategy strategic tools. It can be used to provide benchmarking insights while at the same time providing the basis for identification of a differentiated ‘extension’ to a service or product.

The classic, and well known, example of this technique which has been widely discussed is that of South West airlines:

Here we can see the factors that were used in the benchmark across the bottom of the diagram. The airline industry standard is represented by the red line. South West Airlines also looked at a ‘similar’ industry, car rentals, to help identify an element of differentiation. They completed the exercise by:

- Selecting prime areas where they would not compete

- Creating an area that the other airlines did not benchmark.

The vertical axis did not contain highly accurate and researched data but simply a range of relative importance to the consumers.

The use of this simple mechanism to compare to a benchmark can pay enormous dividends without incurring a huge research cost.

Critical Success Factors

When building a strategy, organisations tend to move very quickly to defining objectives or projects. This is a mistake. Having spent time authoring a Vision, moving to the detail without determining what is important can result in a lot of wasted effort. By defining a set of Critical Success Factors an organisation can hone in those things that will accelerate change and improvement.

The concept of a Critical Success factor was fully developed by John F. Rockart of the MIT Sloan School of Management. He said Critical Success Factors are:

“The limited number of areas in which results, if they are satisfactory, will ensure successful competitive performance for the organization. They are the few key areas where things must go right for the business to flourish. If results in these areas are not adequate, the organisation’s efforts for the period will be less than desired.”

Where a Vision can provide an overall strategic direction, Critical Success Factors provide focus on the few things that need to be done to ensure success. For example, a mobile phone network company might have the Vision:

“Transforming society through the provision of ultra-high-speed mobile information and entertainment services.”

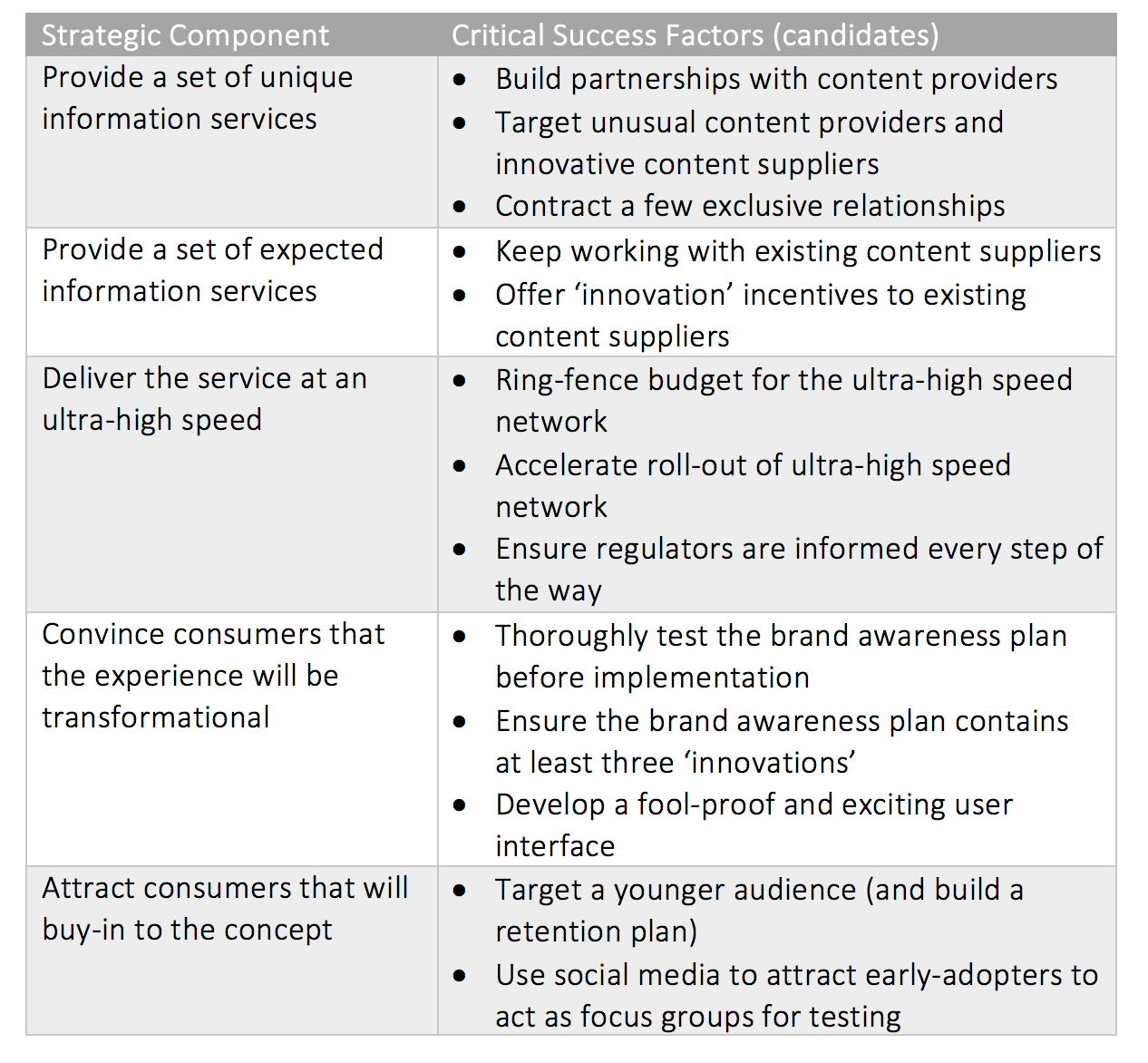

By breaking this down to the actual (and implied) strategic components we can see that for this mobile network company to succeed they must:

- Provide a set of unique information services

- Provide a set of expected information services

- Deliver the service at an ultra-high-speed

- Convince consumers that the experience will be transformational

- Attract consumers that will buy-in to the concept

These strategic components provide the basis to conduct a Critical Success Factor analysis. Generally, the strategic components describe what an organisation needs to do to. The Critical Success Factors will describe how that will be achieved. The first step is to create a set of ‘candidate’ Critical Success factors:

The final list will contain far too many Critical Success Factors and will need to be refined to those that require full attention, funding and resources. The actual number of Critical Success Factors you go forward with will depend on the nature of the business, but in general the fewer the better. Three to five is a good rule-of-thumb.

To help shorten the list always go back to the vision, and if required include the Mission statement. In the above example, the most important activities concern content, brand and service, so the three Critical Success Factors would almost certainly be:

- Unique Content Partnerships – Without compelling and innovative content the vision will not even get off the blocks!

- Tested Brand Awareness Plan – The company aspiration is to transform society. This is a big plan. Without a big brand awareness campaign and the recourses behind it, the aspiration will not be attained.

- Superior Customer Experience – Developing a fool-proof and exciting user interface to deliver unique and interesting content must be in place to provide a competitive edge.

The words ‘ultra-high-speed’ are contained within the vision but have not made the cut into the Critical Success Factors. Is this a mistake? Possibly, however, this company is clearly in the business of delivering an ultra-high-speed network. It is what they do, it is their day-job and therefore part of their Mission rather than part of their Vision. Delivering the network is something that will happen regardless of the Critical Success Factors, so there really is no need to include it.

Critical Success Factors force an organisation to prioritise and focus on a few things that must be done to achieve a Vision. They break the vision into manageable components and aid the process of developing a strategy.

Conclusion

There are numerous strategic tools that could be looked at to help develop a strategy. The few described above, if used carefully, can be mixed and matched to provide full coverage, specifically to assist in the analysis stage.

Download the whole guide: What is a Strategy?